From The Maven Letter: 11 October 2023

Metals markets are boring boring boring. A few stocks are doing well but all others are sideways at best, sliding if worse. And there’s no reason to think this will change soon.

-

Metals move when shortages come to the fore. Many metals will move into shortage over the next few years but they are not there yet

-

Metals move when speculators jump in ahead of shortages. This isn’t happening because (1) investors use this tactic when they see global growth ahead and growth is uncertain and (2) speculators have all kinds of other options (AI, biotech, etc)

-

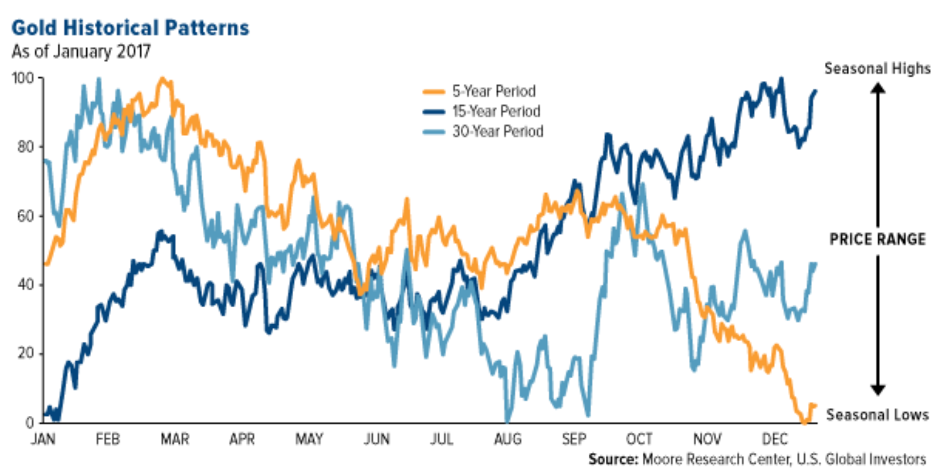

November and December are rarely good months for metals. That goes for all metals, but especially for gold. As the chart below shows, the last metals bull market reduced the weak seasonality of the end of the year but if you look just at the last 5 years or look across 30 years (so the last bull market is diluted) the pattern is the same: gold slides into the end of the year

Of course, seasonality is only the undercurrent. Overtones matter more, like a new (renewed) war in Gaza that has investors worrying about the potential for wider conflicts involving Iran and the (debt-ridden) US. That sad development boosted gold in the last week.

The recession question also remains ever present. Should that happen, gold will move as a safe haven and hedge, paying no mind to seasonal patterns.

But if overtones remain subdued and seasonality holds sway, there isn’t particular support for gold in the coming months. Same goes for copper, nickel, zinc, and silver.

So what’s a bored metals investor to do?

Couple options.

-

Nothing!

This is absolutely a valid option. If you like the stocks you own and are comfortable holding them thru whatever happens with metals in the coming months – most likely more boredom, punctuated by some down stocks falling more as tax loss selling hits, with a possibility of gold starting to run if geopolitics or economics go sour – then hold it is.

-

Lean into discoveries

I’ve discussed this lots lately. Great new discoveries shine no matter the markets. I’m leaning into stocks that I think offer the potential for shiny discoveries as one of my ways of (hopefully) finding profit and excitement in the near term. My favorites are Blackwolf, Cascadia, Headwater, Ridgeline, and Sterling Metals. (Read my comments on Blackwolf in Portfolio Updates for more on that one.)

-

Play seasonality

Gold’s seasonal run in January and February is pretty reliable. That means gold stocks – bigger ones – offer pretty reliable gains for traders who buy around Christmas time and sell before March hits. The chart below is Wheaton Precious Metals, which I chose just because it’s a big gold stock.

The trade didn’t work in 2018. It was lining up to happen again in 2020 when COVID derailed everything. It worked insanely well in 2016 when the bear market officially ended.

Excluding the outsized 2016 run, these seasonal trades returned an average of 31%. If you’d tried also in 2018 (and lost 10%), the tactic still returned an average of 25%. That assumes buying at the bottom and selling at the top (easy in hindsight!) but buying in mid to late December and selling in mid to late February captures most of the gains each year.

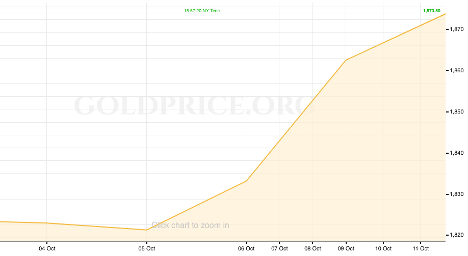

4. Uranium

This is another topic I’ve discussed lots lately but it absolutely deserves a spot on the What to do now? list. The uranium market is taking a breather right now, consolidating intense gains in August and September, but I have confidence it will run again. The spot price leapt higher last month on very small trading volumes because there just isn’t any supply available. That hasn’t changed. Uranium users have paused on buying, not wanting to inflame the price further, but soon needs will trump and they will start trying to buy again.

I think there is a lot of upside left in this uranium market and that upside will likely develop over the next 1-2 years, unless a major recession hits. Perhaps this should be option #1 on the list!

5. Buy ‘First Turners’

When gold turns, it often turns quickly. And certain gold stocks start to lever its gains almost right away. If you are in the Heading Into Recession camp, you might want to buy a few such stocks in the next while so you own them when the proverbial poop hits the fan and gold steps forward as the safe haven hedge it has always been.

The kinds of stocks I’m describing are mid to large gold producers (Barrick, Newmont, Agnico Eagle, Iamgold, Argonaut, B2Gold), top tier single mine operators (Orezone, Wesdome), and near-build or under construction gold developers (Marathon, Troilus, Montage). This is by no means a comprehensive list – these are the first companies that came to mind in each category, as examples.

This content is available thanks to subscriber support. To subscribe to the Maven Letter, see subscription options here or click the button below.