From The Maven Letter: 13 December 2023

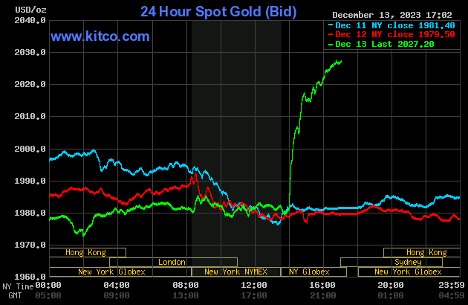

I’ve talked a lot about rates in the last while. I had to because they were THE reason gold moved decisively up through $2000 per oz. and rate expectations are THE factor that will determine where gold goes from here.

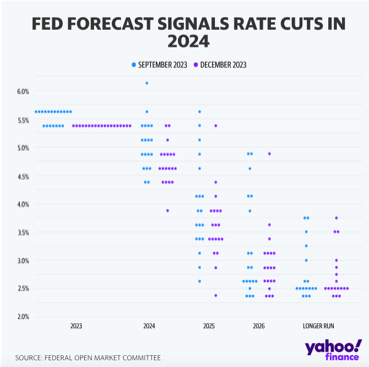

Today was a big rate in the world of rates: a Fed rate decision (unchanged at 5.25 to 5.5% – no surprise there) and a dot plot updating where policy makers see rates going. The FOMC only updates its dot plot every other meeting, so we only get this look at official rate expectations four times a year. Here it is.

I used Yahoo’s version of the dot plot rather than the official one from the Fed because this one compares policy makers’ rate outlooks from September and today. The difference is not dramatic but it’s important.

Look at 2024. The blue dots show that, in September, Fed officials expected to make 1, or maybe 2, rate cuts next year. Today they expect to cut 3, perhaps 4, times in 2024.

Three cuts to get to a Federal funds rate of 4.5-4.75% is a different outlook than one cut to get to 5-5.25%. Importantly, it justifies sharp drop in yields that we just experienced – they dropped more than 3 rate cuts worth, but confirmation that the Fed not only expects to cut next year but expects to cut several times supports the concept of positioning for a declining rates environment.

The rationale for cutting is simple: the Fed doesn’t want to leave it too late. Much of the impact from the ramp-up to the highest rates in 25 years is still pending because fixed-rate debts (mortgages, corporate debts) don’t get more expensive until they are rolled over into the new high-rates world.

Rates didn’t start rising notably until mid-2022, which means that so far only debts due for renewal in the last 18 months have been renewed and become much more expensive. But the longer rates stay high, the more debts will have to be renewed at those levels, creating a heavy and multi-year economic burden.

So even though there is no need to stimulate the economy, which is the main reason to cut rates, the Fed thinks it’s time to start cutting proactively. Unemployment is not high but it keeps sneaking higher, good inflation is gone and services inflation is slowly moderating, and GDP growth is ok but not great – all reasons to stop using high rates to choke growth and instead cut some, so that rates are high enough to keep rampant activity in check and therefore hopefully keeps inflation in check but also lower enough to support ongoing growth and hope that massive debt loads don’t drown too many households and businesses.

Hence plotting out 3, perhaps 4, cuts in 2024. Note that the dot plot does not suggest when in the year cuts will happen. Traders see only 16% odds of a cut as soon as January, but 80% odds of a cut at the March meeting and 97.3% odds of one or more cuts by May 1st.

And even though the new dot plot says 3, maybe 4, cuts in 2024, the market is still betting rates will be between 3.5 and 4.25% next December, which would mean 5 to 7 cuts.

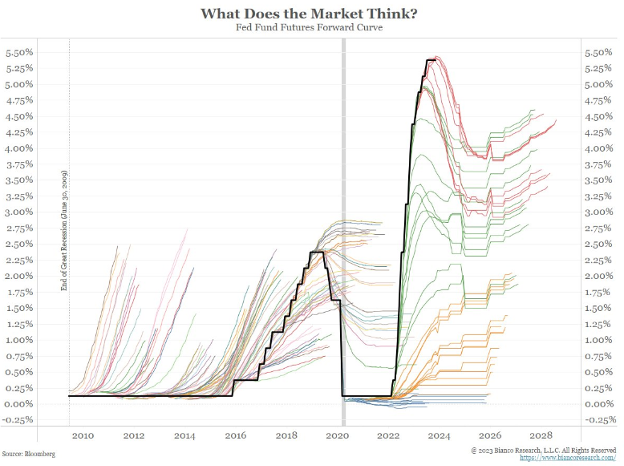

The biggest difference between the Fed and the market predicting the path ahead is that the market can talk openly about recession if it wants, while the Fed cannot. I mean, if signs were apparent they certainly would talk recession, but the Fed cannot forecast a rates path based on a presumption that we’re heading into a recession…at least, not without causing panic. So whether or not Powell and pals think a recession is nigh, in the interest of not sparking a stock selloff and inducing a recession they cannot forecast assuming one.

Now, I don’t really think the market’s much aggressive rate hike forecast is actually because a significant chunk of traders think there will be a recession in 2024. I think the combination of

- The huge change in setting and mentality, from rates running higher to rates falling, and

- Awareness that a recession is possible

Has investors positioning for cuts more aggressively than is logically justified.

But expecting rates to change more sooner is what the market always does. I included this chart last week but I’m going to throw it in again to underline that point.

This matters because the biggest risk for gold over the next few months is the market stepping back its rate cut expectations. Gold rises when rates fall. That is what propelled the yellow metal up through $2000 per oz. two weeks ago. And it is why gold, after sliding back below that round number early this week when strong jobs data put cuts into question, burst back up through $2000 today when the Dot Plot confirmed that the Fed plans to cut.

If the market were to decide it had, in fact, significantly overestimated rate cuts next year, yields would rise and push down on gold. But this Dot Plot put that fear to bed for a while, which is a lovely way to head into the Christmas holidays!