From The Silver Stock Investor | August 2023

Last month my article delved into how solar panels work, why they need silver, and why they are going to need a whole lot more of it for years and decades to come.

Naturally, silver’s properties as the most reflective element, and the most conductive for heat and electricity, make it uniquely suited for solar panels.

In this article, I’m going to look at some recent research that shows how I’ve reached my conclusions about the insatiable demand for silver from solar.

The International Energy Agency’s recently published annual report on global energy investment is eye-opening. They add up how much is spent, by whom and on what. And last year, there was about $2.8 trillion of investments into the energy sector, of which $1.7 trillion went to clean energy.

That’s the most…ever.

This is largely being driven by policy. Governments around the world are setting low emissions targets in a bid to shore up energy security and move to renewable and cleaner fuels. That means really big money is being funneled into solar, amongst other technologies.

But here’s where it gets exceptionally interesting…for silver.

2023 is expected to see solar investment surpass oil production investment. Yes, you read that right. Just 10 years ago, solar was just one sixth of oil investment.

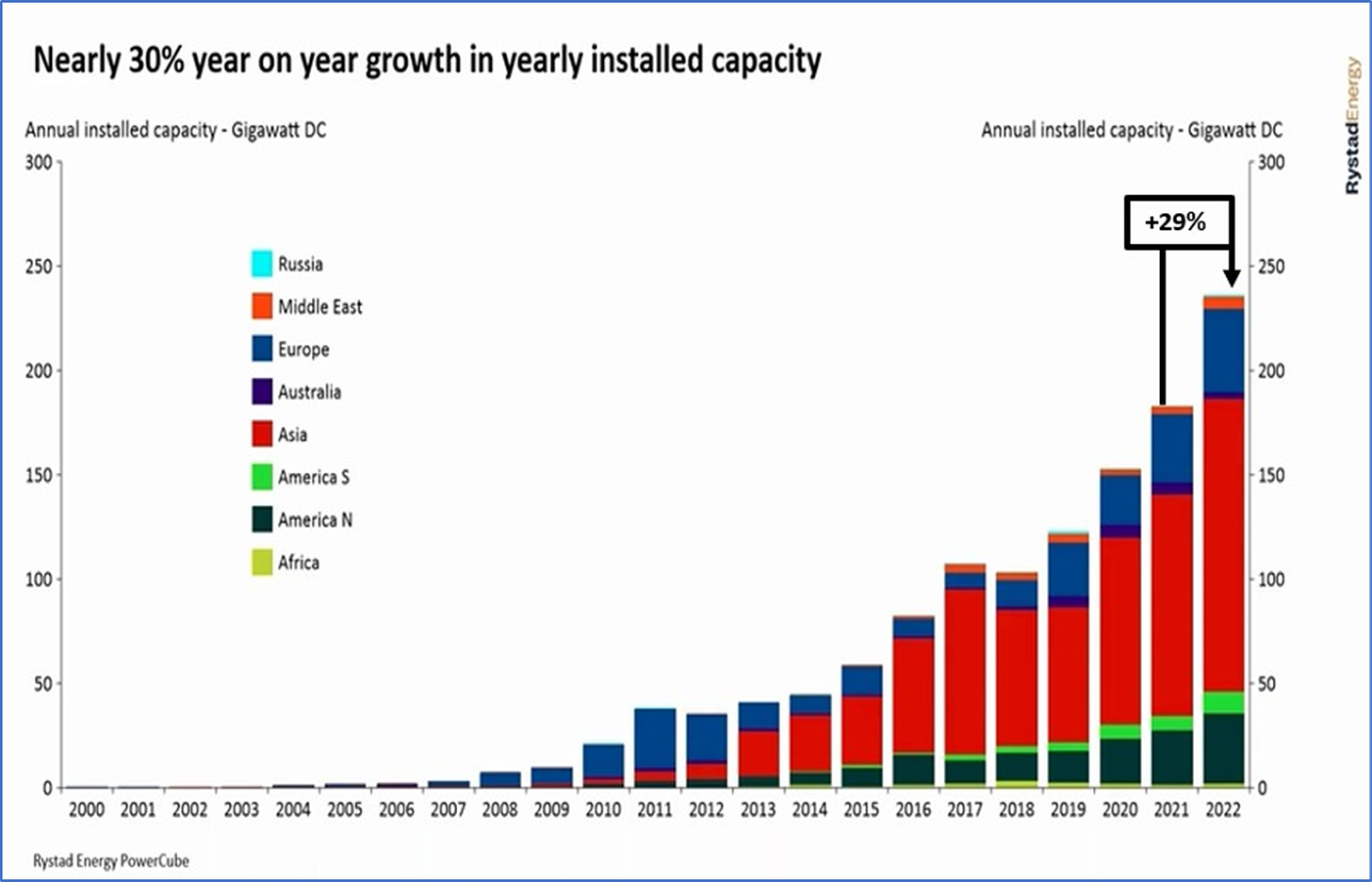

Digging deeper, we can see how solar is outpacing oil. Growth has been coming in at a breakneck pace, especially in the past four years. We saw an incredible 29% increase in installed solar capacity from 2021 to 2022, and we’re on pace for similar growth again for 2023.

According to Rystad Energy, a research consultancy, last year 58% of new solar PV installed was in Asia, followed by Europe at 16% and North America at 14%. A similar trend is expected for 2023, with Asia leading at over half of solar installations, while Africa is expected to increase somewhat.

BloombergNEF Projections sees Chinese solar installations coming in at triple their 2021 levels with 152 GW, which would be more than all the total US installed capacity at 142 GW.

And yet the US has become a lot more aggressive on renewables. Vegard Wiik Vollset, VP Renewables & Power Research at Rystad Energy, recently said “Last year’s Inflation Reduction Act is putting the US on track to become one of the most cost-effective locations globally for harnessing utility-scale renewable energy.” And this is thanks to the Act’s investment tax credits (ITC) and production tax credits (PTC) which significantly reduce expenses for renewable energy projects.

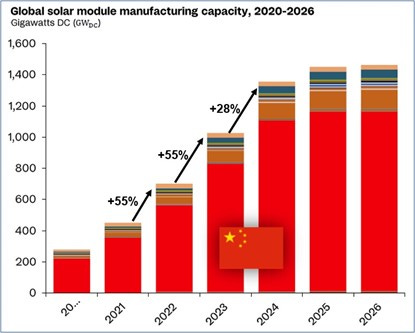

We also know that China dominates solar panel production, with 81% of the world’s solar module manufacturing capacity. And that itself has been growing at a blistering pace for the past three years.

Worldwide solar manufacturing capacity was up 55% in 2021 and 2022, and is already up another 18.5% so far this year, while it’s forecast to gain a total 28% in 2023.

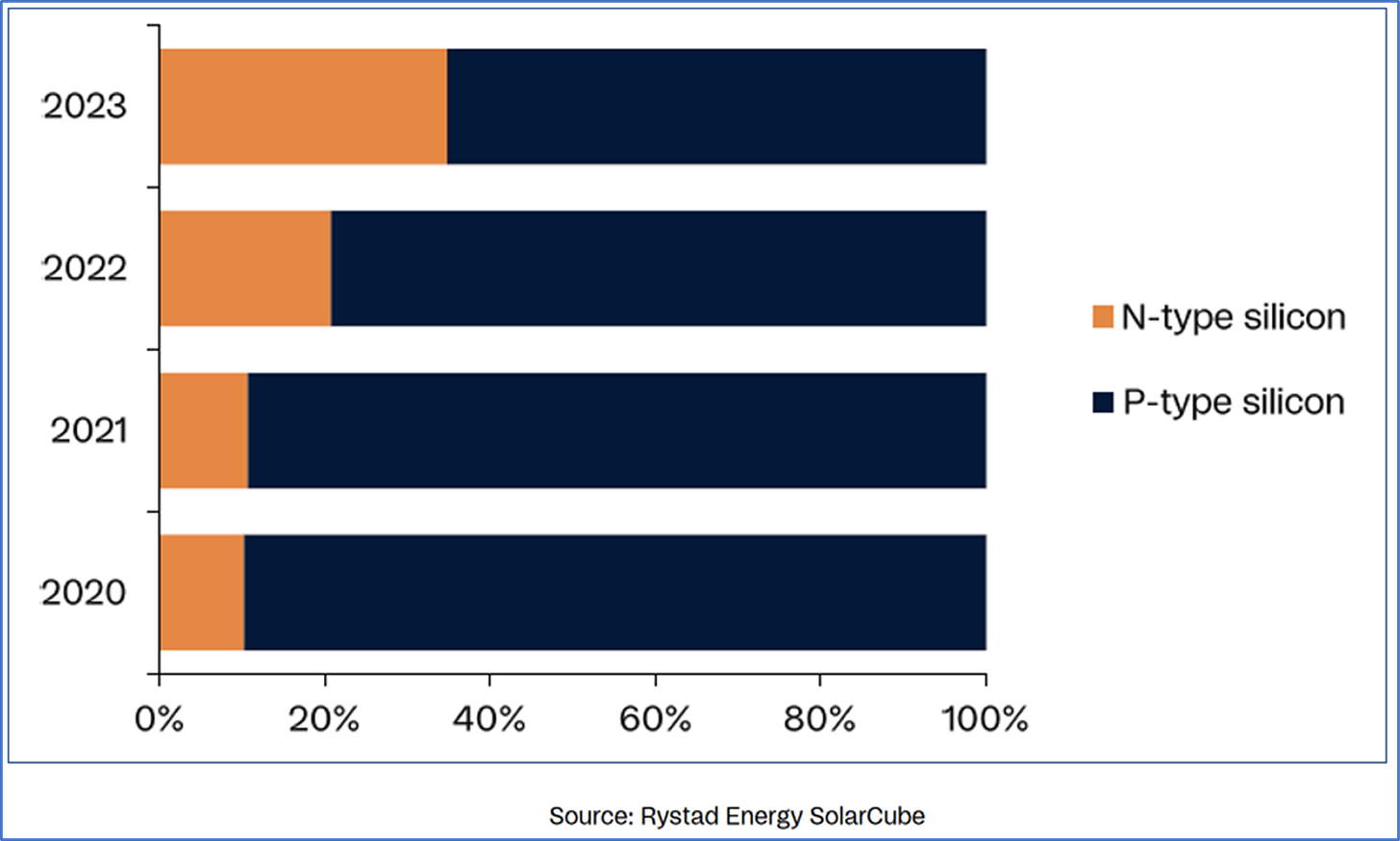

Then there’s the whole question of technology. As I’ve mentioned previously, solar panel technology is migrating quickly away from PERC, the current standard, toward TOPCon and HJT, which require 50% – 150% more silver per panel with higher output. Rystad tells us that in 2023 they estimate 80% of new solar cell manufacturing capacity will use either TOPCon or HJT. As a result, by the end of this year, these two technologies will represent almost one third of all cell manufacturing. Just three years ago, it stood at just 10%.

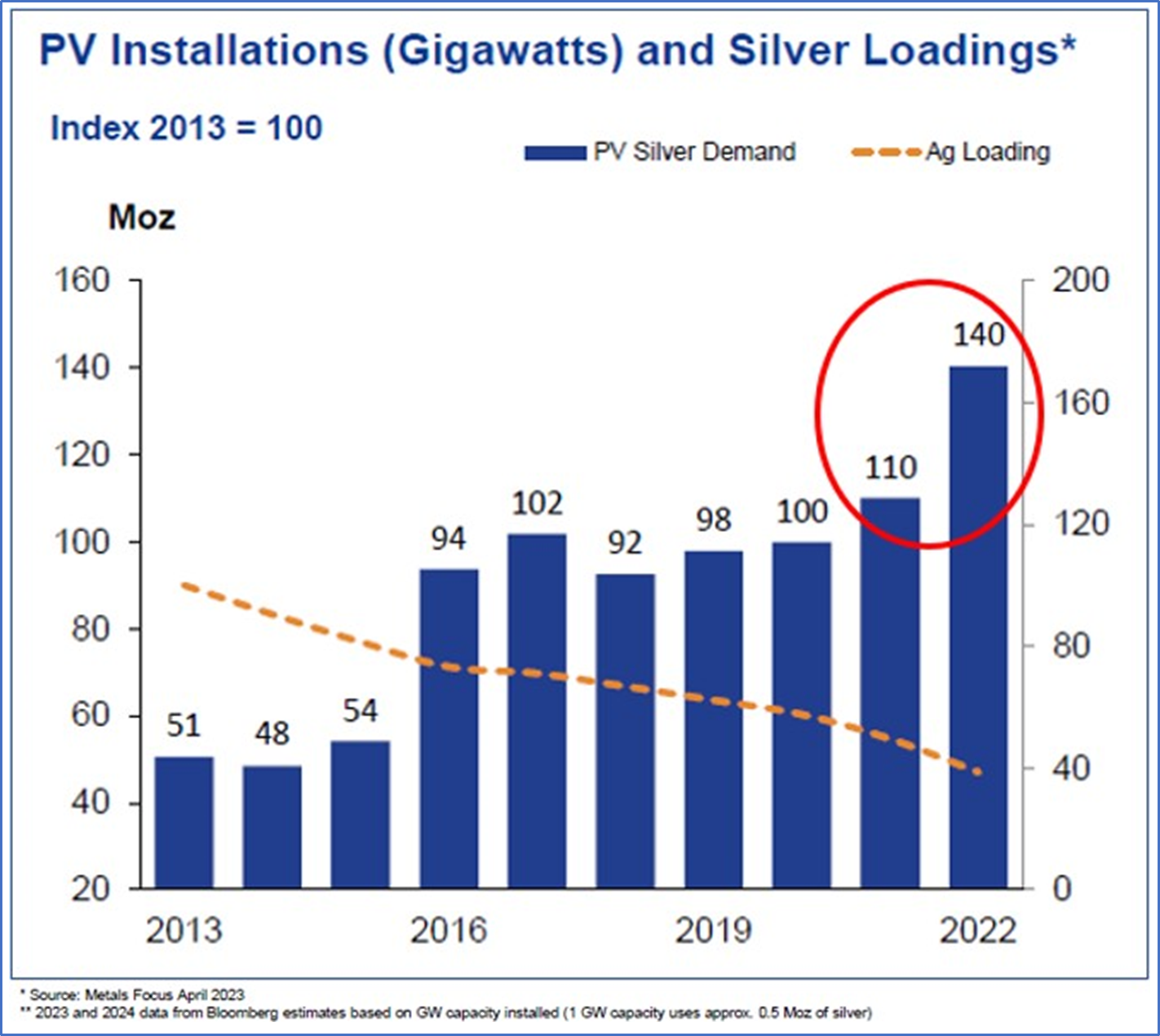

In this next chart, we see two important data points. First is the huge jump in silver required to produce solar panels, from 110Moz in 2021 to 140Moz in 2022. Then there’s the dotted orange line which represents silver loadings. That’s been falling steadily for a decade, as manufacturers constantly strive for efficiencies and reduce costs. That’s allowed them to lessen the amount of silver needed per cell.

There are limits to efficiencies. What this doesn’t yet reflect is the huge jump in silver required for TOPCon and HJT panels. I think we’ve now reached an inflection point. Going forward, I’d expect to see the silver loadings start to climb quite significantly as these newer technologies increasingly dominate manufacturing capacity.

Given the stunning record deficit last year of 237Moz silver, it’s difficult to imagine a scenario where the silver market is not seriously impacted.

In an email exchange I had with Rystad’s Marius Mordal Bakke, Senior Analyst, Solar Supply Chain Research, l asked him What are the odds we will reach the IEA’s 2050 net zero targets, given commodity requirements, supply chain restrictions, etc. In his reply he said, “While solar’s part in IEA’s net zero target is significant, it cannot meet the target alone. I will however try to answer from the solar supply chain perspective…Staying within the silicon-based value chain the only supply material we are slightly worried of going forward would be silver.”

And in a recent report ANZ Bank made the following statements:

- “By 2025, we expect industrial demand for Silver (from solar) to make up 53% of total demand. This will place increasing pressure on supplies.”

- “Growth in mine production is largely beholden to other metals projects for which Silver is a by-product.”

- “We estimate the Silver market is entering a period of tightness unseen for decades. This may not be alleviated by higher Silver prices.”

What could go wrong? There are, of course, no guarantees. We know that the silver market is struggling to produce more. Silver mining was down 1% last year, and when you factor in recycling, it was flat. Zero supply increase in the face of a scorching 18% demand increase.

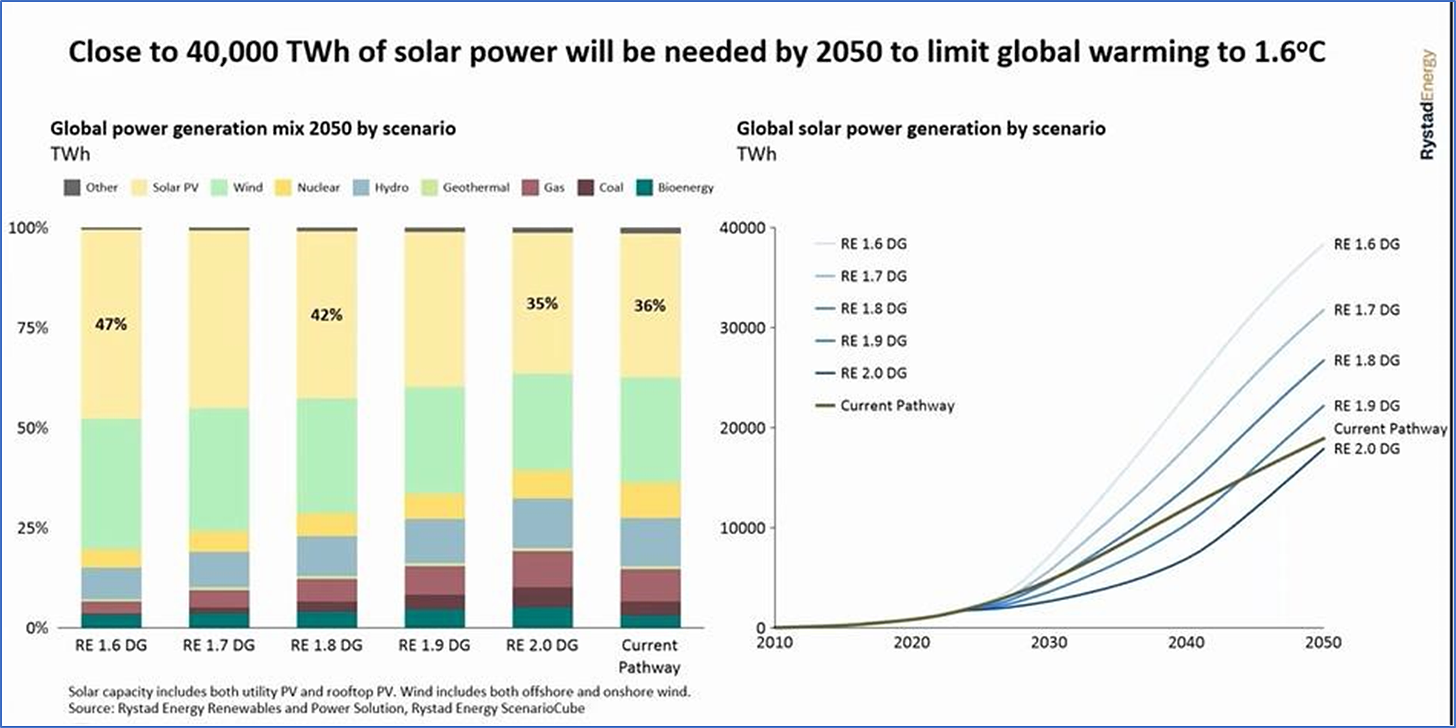

Industrial demand looks likely to stay robust. Solar appears set to take an even bigger slice of the silver demand pie. It seems improbable that governments would now back away or lessen support for the transition to renewable energy in their net-zero carbon emissions targets. Rystad tells us that we’re currently at 1,500 TWh from solar. It’s estimated we will need 25 times more solar power (to reach ~40,000 TWh) to limit global warming by 1.6 degrees, targeting almost 50% energy from solar by 2050.

Still, a decent portion of silver demand comes from electronics and medicine, amongst a few others, which may suffer somewhat if/when we hit a recession. That said, the Silver Institute expects to see industrial silver demand gain 4% this year.

The other side of the coin is silver’s monetary side (pun not intended). There’s investment demand, as well as jewelry and silverware. Investment demand hit a new record last year at 333Moz. That was an impressive 22% increase over 2021, and a new all-time record. If a recession does take hold, I’d expect to see investment demand strong and at least partially offsetting potential industrial demand weakness. The Silver Institute expects overall demand to drop by 6% this year. I think that’s unlikely, mostly because I see their solar demand forecast as being significantly underestimated.

As I’ve shown in the bulk of this article, solar manufacturing and installations are poised to see big increases again in 2023. That will inevitably trickle down into silver demand for all the reasons I cited. Consider too that the International Energy Agency forecasts solar power capacity to surpass both coal and natural gas as early as 2027.

Considering all these drivers, I expect to see solar demand for silver reach 180-200Moz, rather than the Silver Institute’s estimate of 161Moz.

Given the challenges in finding, permitting, and building silver-producing mines, I think 2023 and many more years ahead will continue to foster tight silver markets. And the solar sector is likely to have a growing role to play in expected silver market deficits.

If you would like to read the full letter, you can subscribe to Silver Stock Investor here.