From The Silver Stock Investor | Mid-month Update December 2023

Investors are starting to wake up and recognize the exceedingly bullish setup in the silver market.

Let’s look at what was expected for 2023, how it’s turning out, and what we can look forward to in 2024.

Although overall total demand is expected to ease by about 10% to 1.14 billion ounces for 2023, that’s still the second highest level on record. After a record deficit of 253 million ounces in 2022, the silver market is facing a 140 million ounce shortfall for 2023. I think we’ll see 2024 end with another sizeable shortage of about 150 million ounces. The Silver Institute expects significant deficits will persist for years. In fact, the cumulative total deficits of 2021, 2022 and 2023 are approximately 474Moz, which is nearly 50% of 2023’s total supply.

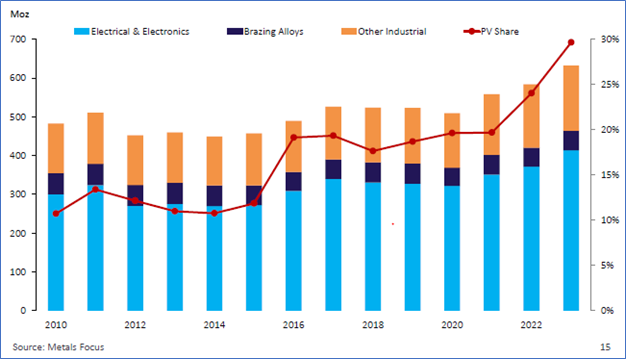

Industrial demand reaches a new record high of 632Moz silver in 2023, driven in large part by the green transition technologies of solar panels, upgrading power grids and 5G telecom, as well as EVs and their chargers.

Reviewing the Silver Institute’s World Silver Survey 2023 from April, a few key points stand out. The big news relates to demand from solar panels. In 2021 110Moz silver went to solar panels. Last year saw 140Moz silver go to that application alone. In April the Institute said 2023 would see solar demand rise to 161Moz. Then in its November update, they said that thanks to overall industrial demand growing by 8% to a new record high, solar demand would represent 30% of that number, or fully 190Moz.

That’s an impressive 73% jump in just two years.

So what’s driving this? Well, a few things.

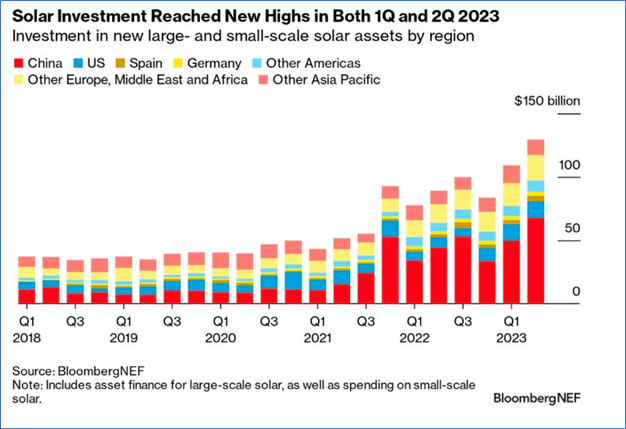

Governments worldwide are mandating and encouraging the move to green energy. Society is being required to go green, while subsidies and grants are making solar panels a lot more affordable. As well there are economies of scale, whereby the more production grows, the cheaper each unit becomes.

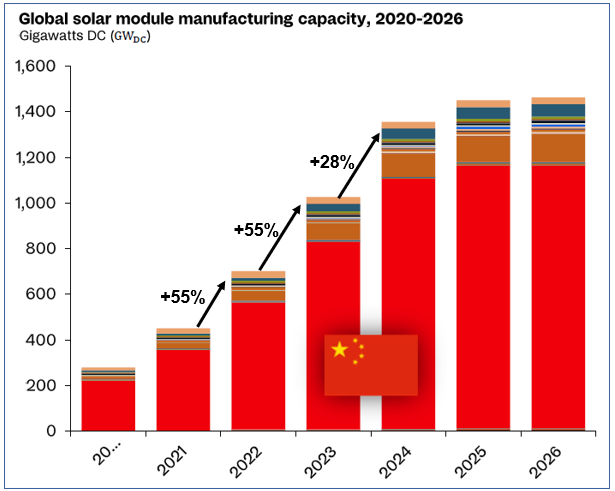

We’ve seen this in the massive growth of production capacity which continues to be dominated to the tune of about 80% by China.

Source: Rystad Energy, Silver Stock Investor

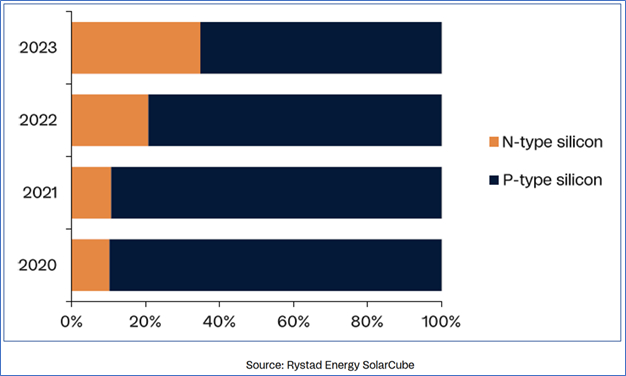

But it’s also being driven by a rapid move towards more efficient photovoltaic technologies like TOPCON and HJT. These require 50% – 150% more silver per panel but produce more energy output. And the market is quickly adapting: TOPCON and HJT were 10% of production capacity in 2020, while this year they are expected to have more than tripled to 35%. It’s little surprise that the International Energy Agency has pegged solar to become the number one power source globally by 2027, surpassing both coal and natural gas.

Meanwhile silver jewelry and silverware are seeing weaker demand in 2023 as India, which is a large market, returns to more typical demand levels after massive buying in 2022.

The Silver Institute estimates that physical demand is about 21% lower in 2023, dropping from a banner 2022 of 333Moz to 263Moz. And yet that also remains at very elevated levels historically. I think the odds of recession are high, and along with that will come Fed rate cuts. That’s a scenario for lower real interest rates, which is bullish for silver. Therefore, I expect physical demand to rise in 2024, likely reaching about 290Moz.

Then there’s silver ETFs. After seeing massive demand in 2020 of 331Moz net investment, followed by another 65Moz net investment in 2021, 2022 suffered net outflows of 126Moz in 2022, and about 40Moz this year. I expect that silver ETFs will see net inflows of about 80Moz in 2024, driven by recession and falling interest rates.

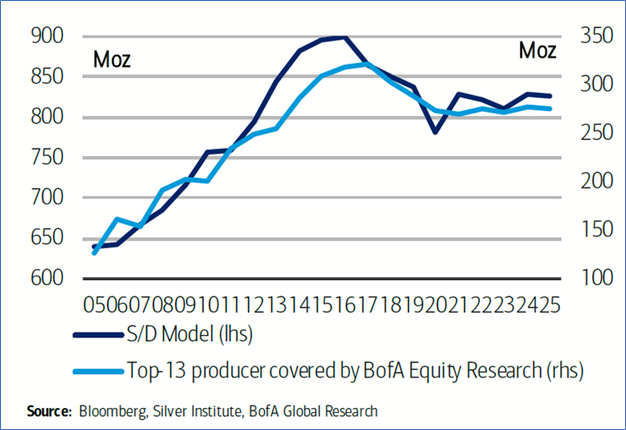

Meanwhile the supply side of silver continues to look tight. Total supply is down 2% for 2023, but less than total demand, leading to the deficits mentioned earlier. And that’s despite recycling being up 1%. The key here is mine supply. Even with demand high and remaining at elevated levels, silver mining output is unable to keep up. Mine supply peaked in 2016 at 900Moz and has been falling on balance ever since to 820Moz for 2023, with no real relief in sight. Few new silver deposits are being discovered, and lead times to production continue to grow. Total supply is expected to drop 2% for 2023.

According to a recent study by Bank of America Global Research, the largest silver miners’ guidance suggests silver output will not regain its previous peak of 2016 anytime soon.

So what does all this mean going forward?

I expect the silver market to remain tight, with deficits for years to come. These are typically met in two ways: net selling of physical bars, coins, and scrap silver, along with net selling of ETFs, and even ETF unitholders and futures contract holders taking physical delivery. As the silver price rises, some supply will come from sellers of old jewelry, silverware, and even coins and bars as they decide to cash in.

But I expect inflation will be like the last guest at your party; they don’t ever seem to want to leave. So although inflation has been ebbing since mid-2022, watch for lower rates to possibly start stoking consumption once again. And then there are the expected three 0.25% rate cuts that Fed FOMC members are forecasting to start in 2024. I have serious doubts we’ll make it to the Fed’s 2% target before inflation starts heading higher once again. The combination of all these factors is likely to stoke rising inflation expectations before long, leading to higher silver prices in the process.

With all this in mind, my targets are for silver to reach $28 in the first half of 2024, and eventually hit the key $30 mark by the second half of next year. And that should dramatically boost the shares of silver companies across the spectrum, from royalties all the way to junior explorers. If you haven’t already, now’s the time to take positions.

If you would like to read the full letter, you can subscribe to Silver Stock Investor here.