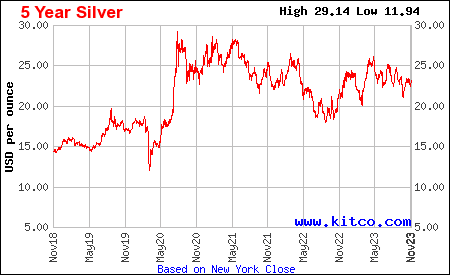

From The Silver Stock Investor | Mid-month Update November 2023

Silver is volatile, there’s no denying it. But that’s also part of its appeal.

I’ve seen it time and time again. Silver will go through an extended period of sideways price action, then explode higher or sell off hard before recuperating, then go back to trading in a limited range.

Knowing that silver acts this way is key to taking advantage of its behaviour. As investors it helps us to remain patient, build a position gradually, take profits after a runup, or cut our losses early when a correction starts.

I’m going to examine how silver has behaved in previous bull markets to help you better prepare for what may lie ahead. I’ve presented this analysis in one of my very first issues of Silver Stock Investor. But given the long period we’ve endured with silver in a range between roughly $20 and $28, I thought it worth reviewing.

Consider that between 2002 and 2006, silver dropped 10% or more 4 separate times.

Then, between 2006 and 2011, short but sometimes deep corrections came, with silver dropping 13% or more three times.

Overall, from 2001 until its peak in 2011, silver gave back 20% or more four times. But the real takeaway is that anyone who held on from the beginning enjoyed an astounding 1,080% gain.

And yet, the tremendous leverage of silver stocks is not only impressive, but worthwhile having exposure to.

This chart compares the performance of SLV, a silver ETF that mimics the price of silver, with SIL, a silver ETF made up of mostly large silver miners. The chart runs from mid-January to early August 2016.

The black line is SLV and the blue line is SIL. During this six-month period, SIL was up 240%, dramatically outperforming SLV which gained a very respectable 48%. Silver stocks were up by five times as much as silver itself in just six months.

That’s why I want to own silver stocks, as well as silver itself. The leverage can be tremendous.

Where Silver Stands Today

Given the extreme and unprecedented levels of stimulus, money-printing and debt in the last few decades, my view is that we are still in the midst of the silver bull market which started in 2001.

I think silver’s bull could run for the rest of this decade, leaving us with 6 to 7 years to go.

From silver’s $49 peak in 2011 to its $12 bottom in March 2020 silver lost 75%.

The fact that silver bottomed at $12, which was almost triple the $4.14 low in 2001, suggests to me that we are still in the same powerful multi-decade bull market.

My target price over the next few years is for silver to reach at least $300. How I reach that number is a topic for a future issue. But before you think I’m crazy, I can assure you that it’s an estimate relating to the gold price and based on how gold and silver have performed in previous bull markets.

If silver reaches my target of $300, that will be a 1,300% return from its current price near $23.

While that’s a tremendous return, you need to expect volatility and future corrections. But you’ll only benefit if you’re willing to stay the course. There will be opportunities to lock in profits along the way, especially in silver stocks, but you need to have a core position you’re willing to hold through corrections for maximum gains.

Bull markets do their best to bring along the fewest participants. Just don’t let the silver bull shake you off.

If you would like to read the full letter, you can subscribe to Silver Stock Investor here.