From Evergreen Investing: July 2023

We spent the first six issues of Evergreen Investing explaining the six sectors we want our portfolios exposed to for the huge investment opportunity of the green transition: nuclear energy, metals, carbon credits, waste management, agri-food, and green infrastructure. And we named what holdings we bought for that exposure and why.

This month I want to underline why we have such confidence the green transition is a huge investment opportunity. It boils down to three things: certainty, scale, and needs.

Certainty: Governments around the world have committed to the green transition. I’ll run through some of the many pledges made and laws enacted that mean green is the path forward…and the much bigger promises that have been made but not yet legislated that will multiply green investments ahead.

Scale: there’s been some green progress to date, to be sure, but the lion’s share of this massive transition is still to come. This transition is changing how we eat, move, build, and power our world. That is creating entirely new industries, technologies, and investment flows, all of which spell opportunity for investors.

Needs: change on a massive scale has big needs. That big needs often cannot be met means massive changes often stall out. But this change cannot stall – it is mandated, legislated, signed and sealed – so the big needs of the green transition will be met. Investors will flock to the opportunity in these big unmet-but-mandated needs once they stop worrying about recession and start positioning for growth and the future.

That’s where we stand today:

• There’s been significant green progress to date but the rate of change must step up soon if governments are going to meet their net zero targets

• In the last few years COVID and recession fears took center stage; green opportunities were pushed to the side. But recession fears are easing and as investors start to position for overall economic growth they will buy green growth, for the beautiful combination of rapid mandated adoption, direct government support, and needed innovation.

Scale

The speed and goals of the green transition vary depending who you ask, but Net Zero by 2050 is the most common. The International Energy Agency’s road map to get there is a very long and involved document. I’ll pull a few of the requirements:

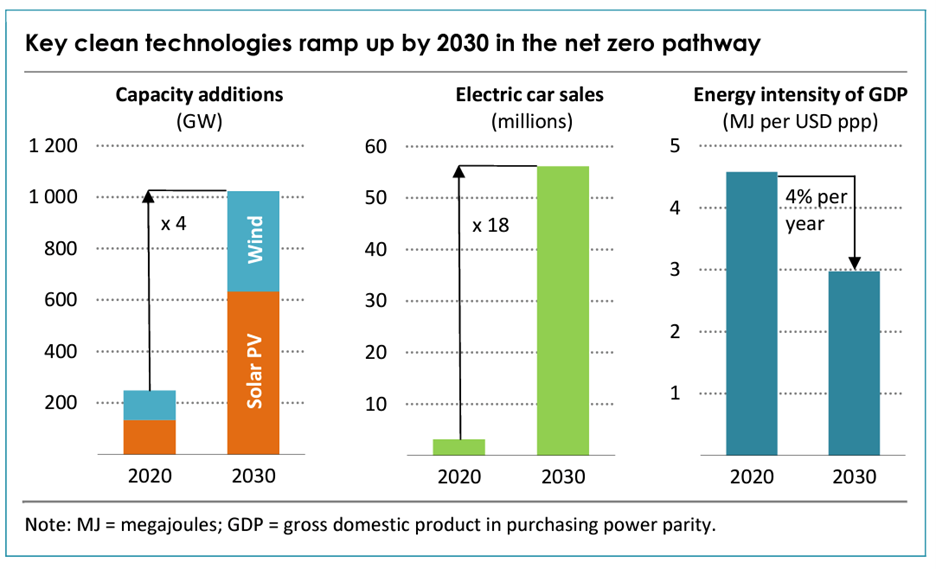

Now to 2030:

• Electric vehicles increase to 60% of global car sales, from 5% today.

• Solar and wind power are scaled up four times faster than the record rate in 2020 to become the leading sources of electricity.

• The rate of energy intensity improvements averages 4% a year, almost three times the average over the last two decades.

By 2040:

• All unabated coal and oil power plants are retired or retrofitted with carbon-capture-and-bury technology.

• 50% of existing buildings are retrofitted to zero-carbon readiness.

• 50% of aviation fuel shifts to low emissions.

• Carbon capture technologies successfully grab 5 gigatonnes of CO2 annually.

By 2050:

• Hydrogen fuel and carbon capture technologies are mainstream.

• Almost all heavy trucks sold are fuel cell or electric.

• 90% of heavy industry shifts to low emissions.

• 70% of global electricity comes from solar and wind

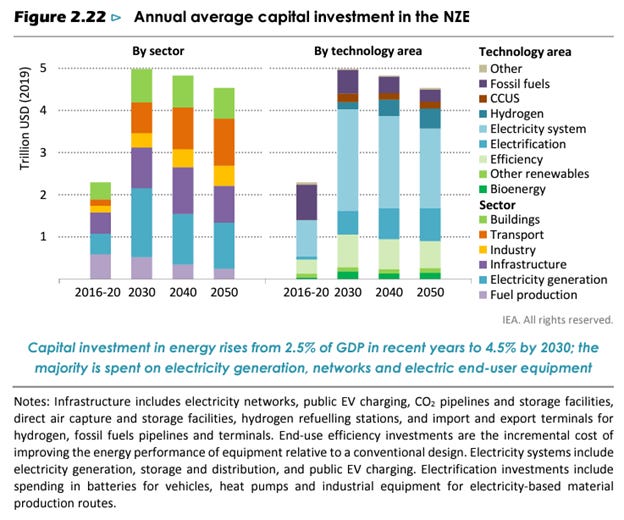

This plus the immense rest of the list is all very expensive. But that’s a good thing for investors: global consensus on the need to spend trillions of dollars annually changing the way we build, power, and move in our world is an investment opportunity.

Some of this opportunity has happened, to be sure. The surge in lithium prices is a good example. Governments around the world lent big support to electric vehicles; it soon became clear that lithium was a weak link to EV expansion and lithium prices responded in spades.

But just because some opportunities have played out should not dissuade anyone from investing in the green transition today. In fact, even though it feels like there have been a lot of green mandates already, the lion’s share of the work is yet to come.

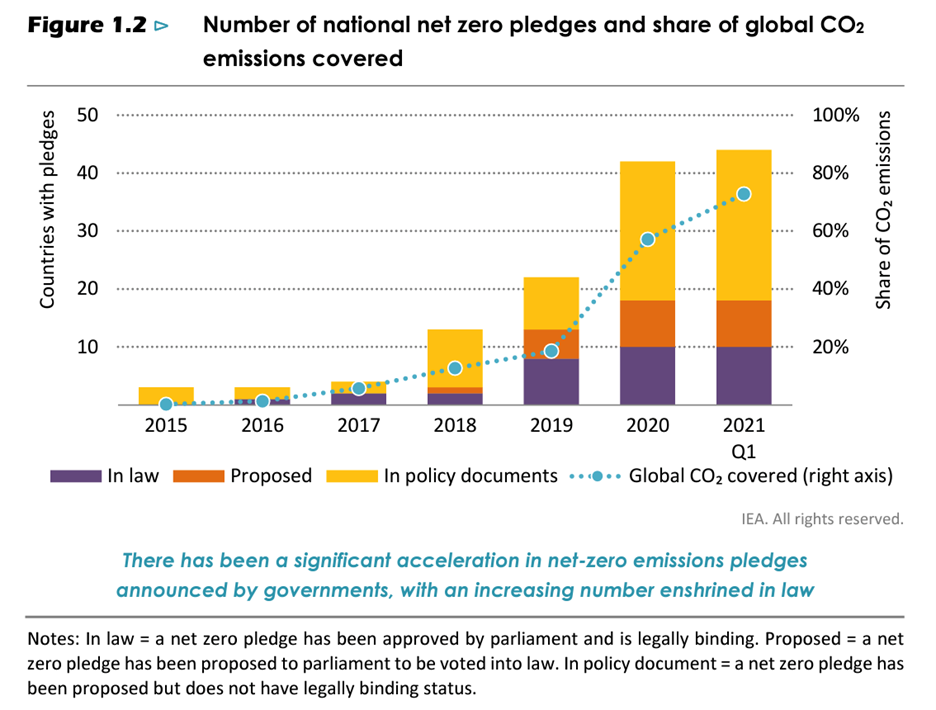

Net Zero pledges now cover around 70% of global CO2 emissions but less than a quarter of those pledges have been enforced via legislation. In other words, three-quarters of the work to get to net zero is still to come.

This matters to investors because the private sector will need to finance a huge part of this transition. To make that happen, policies will be built to reduce investment risks by ensuring success as much as possible. Governments know the only way to achieve these goals is to make businesses and investors see green – the money kind of green! – in participating.

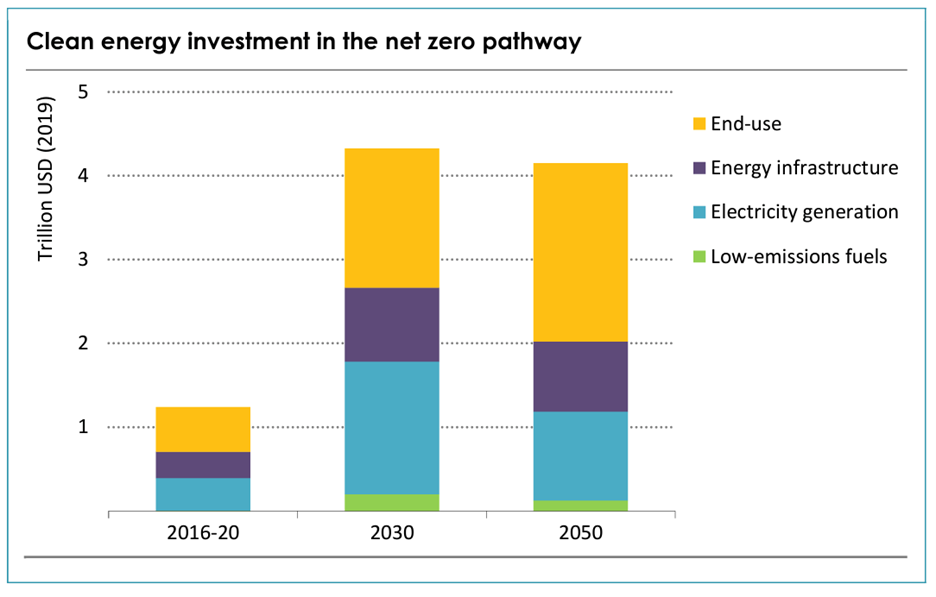

That means the over $4 trillion that must be spent annually over the rest of the decade will drive innovation, boost productivity, and create entirely new industries, which means all kinds of investment opportunity. Mandated innovation is one of the best kinds of investment opportunity because it adds significant confidence around the big returns that new innovations can generate.

Certainty – What Seemed Impossible Has Already Happened

Seeing the scale of what must be done can make it seem impossible, or at least improbable. So I want to list some of the very significant mandates that have already been enacted. I posit that all of these seemed impossible a decade ago; that they are now enshrined in law shows that the green train has left the station and is not going back.

It all started in Paris… It has been eight years since 195 nations signed the Paris climate agreement, which for the first time required every country to submit plans for curbing emissions. The deal spurred all kinds of action: the EU first tightened caps on industrial emissions, China and India started to ramp up renewable energy, Egypt scaled back subsidies for fossil fuels, and Indonesia started cracking down on illegal deforestation, for example.

The other key Paris effect was that, with global support behind it, clean energy technology advanced far more quickly than predicted. A decade ago, solar panels, wind turbines, and electric vehicles were largely niche technologies that were too expensive for mainstream application. But costs have plummeted and adoption has soared.

Of late…

The US Inflation Reduction Act includes measures that could reduce US greenhouse gas emissions by 40% by 2030. The biggest investment in climate solutions in US history, the IRA aims to make green energy the default in major sectors including electricity, transportation, and manufacturing.

The Great British Nuclear Initiative supports operations, development, and new technologies to help the UK hit its target of providing up to a quarter of its electricity from domestic nuclear energy by 2050. Recently added a new $205 million funding package to support development of small modular reactors.

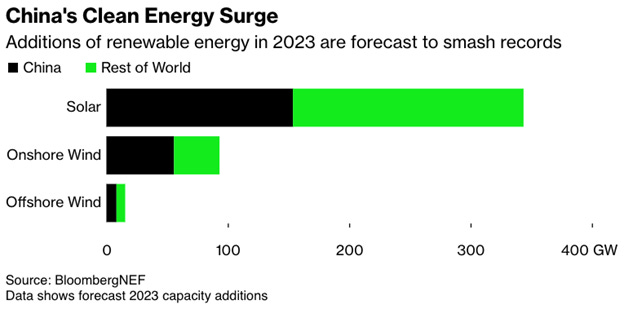

China has so many green policies that I couldn’t even attempt to list or summarize. Its renewable energy installations almost outstrip the rest of the world.

To add to that I’ll just point out three other green China moves that caught my eye recently.

Growing the carbon market – policymakers are working to add the steel sector to the national emissions trading scheme by 2024, which is vital because steelmaking is China’s second-largest source of emissions. (China launched its ETS in July 2021 and it only covers the power sector so far; plans call for it to expand to steel, cement, and petrochemicals.)

Because of significant and sustained government incentives ranging from subsidies to parking spots, a quarter of newly registered cars in China are electric.

President Xi recently pledged to plant 70 billion trees by 2030, part of his mandate for carbon emissions to peak in 2030.

California, with the 5th-largest economy in the world, recently passed another flurry of bills to cut emissions and speed away from fossil fuels. The effort included sweeping new restrictions on oil and gas drilling, a mandate to stop adding CO2 to the atmosphere by 2045, a ban on gas-powered car sales by 2035, and support for the development of carbon capture and storage.

More than forty countries have now implemented a national carbon tax, including Argentina, Japan, Singapore, and Ukraine.

Last year France passed a climate bill addressing a multitude of environmentally unfriendly practices, including eliminating short domestic flights and limiting plastic packaging.

Brazilians elected Lula de Silva president, ousting Jair Bolsonaro who rolled back protections on Amazon deforestation. In direct contrast, de Silva campaigned on protecting the Amazon, also known as the lungs of the planet.

Finland recently mandated a shift to wood-based materials for construction and textile needs.

These are just a few of the multitude of mandates that are requiring individuals and corporations around the world to green their operations. Paradigm shifts are slow until they are fast. It was a very slow grind to get to the Paris agreement; government action has sped up since then but must accelerate dramatically in the next few years for nations to meet their net zero by 2050 promises.

In other words, it’s about to get fast.

I don’t mean to suggest that all countries are mandating net zero. Just this month at a G20 meeting in Goa, India, the world’s biggest fossil fuel producers, namely Saudi Arabia, Russia, and China (coal), all opposed a proposal to triple renewable energy capacity by 2030.

What’s interesting about that setup is the light it shines on another transition investors should be watching: deglobalization. It’s far too big a topic to bite off here, but I will comment on the overlap between the green transition and deglobalization.

The green transition requires all kinds of things that were not much needed before, from solar panels to batteries, rare earth elements to uranium, carbon credits to fertilizers. One of the ways nations are making the green transition happen is by ensuring access to and benefit from these newly essential things.

But deglobalization is also all about ‘things’.

See where this is going? The green transition is amplifying deglobalization: many of the subsidies, tariffs, and other policies implemented to speed the green transition put domestic needs first, widening fractures in a newly fragile system of global trade. It’s happening with critical minerals, with technologies, with industries…with just about every ‘thing’ that’s needed in the green transition.

“The west is now starting to do what China has historically done… You will simply not be able to build a new-energy system and reduce the world’s CO2 emissions without getting sufficient access to a number of minerals.” – Jakob Stausholm, CEO of Rio Tinto

This overlap will amplify the investment opportunity for those who understand the games being played. The first examples that come to mind are that US (and US-friendly, like Canadian and Australian) uranium is splitting off into a separate market that will likely carry premium pricing; that re-shoring US manufacturing has major implications for commercial and residential real estate; and that China’s natural abundance of and dominance in processing critical minerals will send certain commodity prices soaring over the next decade as western buyers compete for scarce supplies.

This content is available thanks to subscriber support.

To subscribe to the full newsletter, subscribe to Evergreen Investing here.