From Evergreen Investing: April 2023

The world is urbanizing as people increasingly move into towns and cities, and away from rural areas.

It’s one of the most impactful demographic trends of our lifetimes.

Today, more than half the world lives in urban or suburban settings. Seventy years ago, it was just one third. Within the next 30 years it will approach two thirds.

It’s a megatrend with huge implications. That’s because, as I’ll detail for you, governments are unleashing some of their largest investment sprees in history to help interconnect people, business, and information in a sustainable way.

Companies and investors on the right side of this spending have a lot to gain. Here’s why…

According to the United Nations, 70% of all greenhouse gas emissions are generated in urban areas, due in large part to poor design and a lack of proper infrastructure. So, it’s important for us to understand exactly what is happening, and what the implications are for us as investors.

As global urbanization accelerates, it increases the need to ensure development and modernization happen in the most sustainable way possible, as more people share and depend on infrastructure.

In this issue, I’ll show you how all areas of the economy will benefit from upgrading, rebuilding, and expansion as we transition towards a green future. You’ll better understand the increasing demands on our infrastructure, how governments and businesses are addressing them, and how I’m investing in this promising area to benefit from burgeoning opportunities.

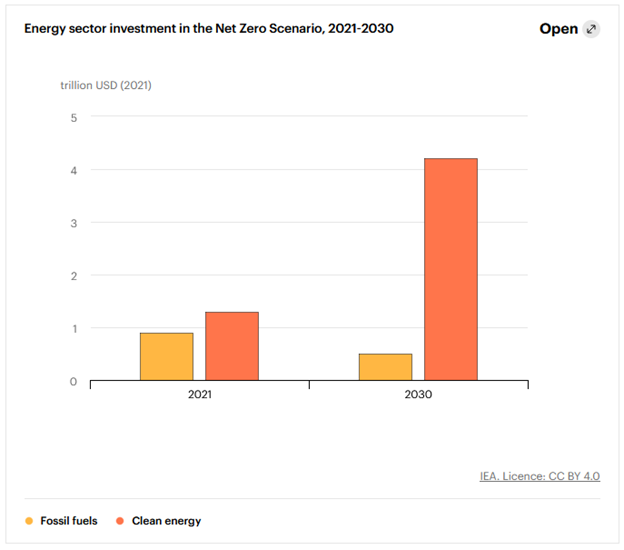

After years of neglect, railroads, highways, bridges, ports, airports, energy, water, power, and telecommunications will all require huge investments over the next several decades. With the green transition in high gear, those investments will be overwhelmingly directed towards developing and upgrading infrastructure in a sustainable way.

As the name suggests, sustainable infrastructure emphasizes delivering environmental, social and economic benefits. According to Global Infrastructure Hub (GI Hub), a non-profit formed by the G20 nations to advance sustainable infrastructure, this area is teeming with potential. As per GI Hub, here’s why:

- 79% of global greenhouse gas emissions are related to infrastructure

- 4% growth in global GDP by 2030 is possible with clean energy investments

- 92% of sustainable development goals targets are achievable through infrastructure investment

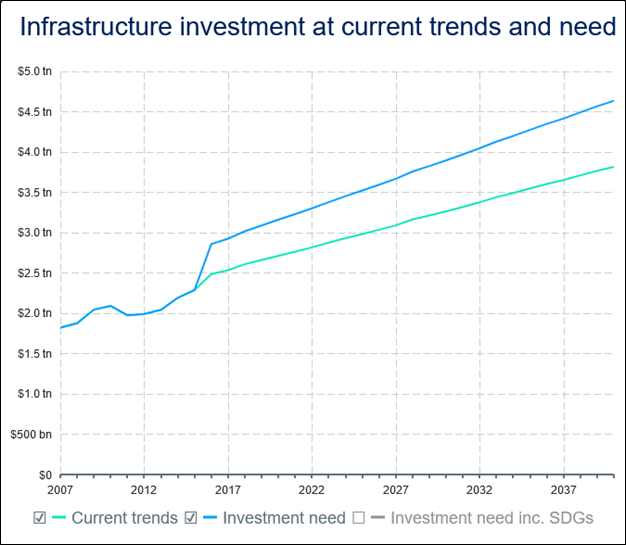

Each of the above points will have a major impact on the planet and our investment outlook for decades to come. The reason is simple. GI Hub estimates that $2.6 trillion will have to be spent annually through 2030 to meet sustainable development goals, and to maintain a path to net-zero by 2050. Even at today’s inflation rates, that’s a whole lot of money.

Why is sustainable infrastructure the way to go? It helps reduce our carbon footprint by relieving pressure on the environment. It supports renewable energies and a more equitable electric grid, potentially providing a billion people with access to energy who are currently lacking. It encourages employment and economic growth that are environmentally friendly. And it brings these life-changing services to many for the first time ever, releasing massive economic potential.

The second major takeaway from the “greening” of infrastructure is there are “mega-themes” that are interrelated like mobility, connectivity, and security. So, emphasis is increasingly being placed on the responsible and sustainable delivery of transportation, energy and communication.

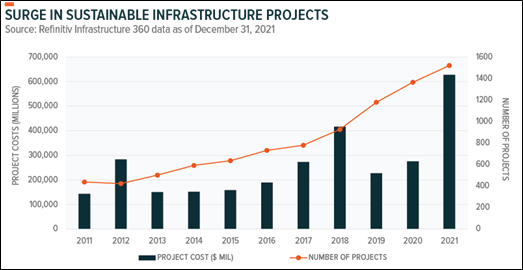

In the last few years, governments have stepped up to the plate in a very big way to make this all happen. As a result, the number of sustainable infrastructure projects and dollars spent has soared and continues to trend higher.

Let’s look at some major infrastructure programs announced in just the last two years.

In late 2021, the US passed a $1.2 trillion infrastructure bill. It covers traditional spending to repair, replace, and build roads, bridges, ports, airports, and energy and water distribution projects. Beyond these, there’s also major funding for transportation research, energy security, and clean energy.

Billions will go towards expanding broadband to rural and low-income areas, resilience in cybersecurity, to replace and clean up polluting and unsafe water infrastructure, and to address flooding, wildfires, coastal erosion and droughts. EVs will get notable support, with a goal to build a national network of 500,000 vehicle charging stations, and the replacement of school buses with electric versions.

Not to be outdone, the European Union unveiled a € 1.1 trillion European Green Deal Investment Plan to cut carbon emissions by 55% by 2030. The plan will support and mobilize public and private infrastructure investment between 2021 and 2027. The plan’s infrastructure emphasis takes aim at climate change by focusing on digitalisation, energy and transportation, but also education and research. More specifically, the Global Gateway will support fibre optic cables, clean transport corridors, and clean power transmission.

Unlike America’s essentially domestic program, Europe’s reaches well beyond its own borders. The Global Gateway supports partnerships in energy transition and digital connectivity as far as Indonesia, the Philippines, Kazakhstan, Mongolia and Tajikistan.

China’s Belt and Road Initiative (BRI), originally launched in 2013, is considered by many as the world’s most ambitious infrastructure plan ever undertaken. Sometimes referred to as the New Silk Road, its original goal was to link East Asia and Europe through infrastructure. Since then it has expanded to Africa, Oceania and Latin America. Given the size and massive impact of such a grand plan, concerns about its environmental impact have grown. To address these, last year four Chinese ministries published a key policy document on the further greenification of the BRI. The policy confirms China’s interest in reducing emissions and pollutants and protecting biodiversity while providing economic opportunities for participating nations. It promises no new coal plants, and it favours green infrastructure in power and transportation while minimizing environmental risks. It even undertakes to facilitate the full implementation of the Paris Agreement on climate change.

India has established the National Infrastructure Pipeline (2019), which aims to spend over $1.8 trillion in infrastructure development through 2025. The country’s plan is all-encompassing, supporting more efficient freight transportation, access to airports, high-speed connectivity, and safety in transportation. With up to 10% of India’s carbon emissions from transport, there will be an emphasis on sustainable mobility through electric and alternative fueled vehicles, as well as green technologies in public transport.

Canada has its own version, the Investing in Canada Infrastructure Program, offering $33 billion in funding with provinces and territories. The program’s Green Infrastructure stream supports projects in several areas. Climate Change Mitigation aims to better manage renewable energy, access to clean energy transportation, efficient buildings, and improved clean energy production. Environmental Quality undertakes to upgrade wastewater treatment, drinking water treatment and distribution, and reduce soil and air pollutants.

It’s clear these sustainable infrastructure spending programs reinforce how developed and developing nations planet-wide are going full throttle on the greenification megatrend.

Here’s one last thought about unleashing trillions in public and private funds into this sector. The World Bank estimates that every dollar spent on infrastructure generates about $1.50 of economic activity. As the risk of heading into a recession increases, people will be increasingly supportive of government spending that offers well beyond a 1 to 1 return.

This content is available thanks to subscriber support.

To subscribe to the full newsletter, subscribe to Evergreen Investing here.