From Evergreen Investing: September 2023

The term “paradigm shift” was first coined by American philosopher Thomas Kuhn in his 1962 book The Structure of Scientific Revolutions. It describes fundamental change in the basic concepts of something and in the resulting practices of how that thing works or can be done.

The box above, taken from good old Investopedia, sums up how paradigm shifts play out for investors. New ways of thinking or doing that totally revamp old orders erase some investments while sending others soaring.

Streaming services annihilated CDs/music stores and necessitated huge changes for cable TV operators but made Spotify and others into huge successes. Online shopping took a huge bite out of the market for brick and mortar stores, while Amazon soared.

Those are smaller paradigm shifts, which make for good simple examples.

The green transition is not small. For better analogues of scale and timing/duration of impact, we need to look to past big paradigm shifts.

The two I will lean on today are the rise of the internet and the rise of China. There are other examples, to be sure, such as the invention of the automobile, cryptocurrencies, antibiotics, and the Great Recession (which shifted many investors from high-flying ideas into seeking sustainable investments).

But those are tiny against the internet, globalization, and the green transition.

The Internet

Here’s what the NASDAQ did from 1995 to 2000.

The advent of the internet pushed the entire index up 5-fold. In hindsight, it happened in a classic bubble shape: a first phase of steady gains and repeat small setbacks from 1995 to mid-1998, a bigger setback, a steeper ascent, a consolidation, and then full euphoria that took the index from 2,700 to 5,050. You can see reason for the euphoria in the volume bars at the bottom – investors who had stayed out through the first tripling gave into their FOMO and bought with abandon.

Of course, an index shows the aggregate performance of its constituent stocks. Some stocks returned multiples of this performance.

Now allow me to show the next three years…

Most of the gains evaporated, and much more quickly than they had developed. The volume bars also add to that story – investors panicked en masse and massive trading volumes pulled the index back to ground in just over 2 years.

I don’t need to explain here why the internet fits as a paradigm shift. We live that every day in how we communicate, find information, and shop. But wait – if the internet paradigm shift persisted, why did stocks fall off so?

Because hype got ahead of reality. True technological advancement from companies like Dell, Cisco, Intel, and Oracle was part of the run but the bubble grew on dotcom companies, of which there were too many with insufficiently developed ideas but lots of marketing. Investors keen to own any and all things internet piled on.

Rampant speculation on thin ideas never lasts. When the NASDAQ topped 5,000 several of the leading high-tech companies, like Dell and Cisco, figured the end was nigh and placed huge sell orders on their own stocks. That sparked panic selling.

Is that how all paradigm shift investment moves play out – a crazy peak followed by an almost total loss?!

No. It all depends on the degree of speculation, which depends on general risk appetite, availability of investment capital, and cost of money. I’ll get into those concepts again shortly.

Allow me one more chart. This shows the NASDAQ from the start of the internet to today. The Dot Com Bubble fades relative to the gains since (following a long boring reset, I will add).

The speculative craze of the dot com bubble turned investors away from tech for years. But savvy investors knew that investor interest was not a make-or-break factor in now the internet and its applications would change the world.

Consider that Apple sold the first iPhone in 2007. The company ground away for 10 years prior, working hard in the new and highly competitive world of personal computers, but in the background Steve Jobs kept pushing an idea that he knew would stand out. That idea was the iPhone and the rest is history.

He wasn’t alone. Companies with real ideas and assets, led by people with conviction and persistence, kept at tech through those down years…and have since been richly rewarded. Oracle and Amazon are standout examples.

OK, hold those those timeframes and forces in your heads while I run through my other paradigm shift example. Then we’ll look at the forces and timeframes at play for the green revolution.

China

Before economics reforms and trade liberalization started in China 40 years ago, the country’s economy was poor, inefficient, and pretty isolated from the rest of the world. When it opened up to foreign trade and investment in 1979, China became one of the world’s fastest growing economies. In fact, GDP growth averaged 9.5% from 1979 to 2018, which the World Bank describes as the “fastest sustained expansion by a major economy in history.”

China has become one of the world’s largest economies and the world’s largest manufacturer, merchandise trader, and holder of foreign exchange reserves. Trade between China and the United States grew from $5 billion in 1980 to $660 billion in 2018. Overall exports surged from just $257 billion in 2000 to $2.4 trillion in 2016, making China the world’s top exporter.

This incredible growth story reverberated through global markets. As a mining specialist, I know firsthand what it did to metals. Spoiler alert: unbelievable growth and value creation once the China machine really got going.

I think it’s best to start with a few charts.

First off, a copper price chart. China may have averaged almost 10% GDP annual GDP growth starting in the 1980s but it wasn’t until two things happened – export volumes ballooned and lifting 800 million Chinese out of poverty created a massive domestic housing boom – that copper started to benefit. Once it did, the impact was impressive. The red metal had been trading around $1 per lb for decades. The intense surge in demand from China from 2002 to 2012 pushed it to $4.50.

Just like the Dot Com Bubble, the China Copper Bubble also burst. But like Amazon and Oracle and the tech-heavy NASDAQ in general, the opportunity did not disappear; it reacted to all manner of forces. It took 8 years for the copper price to drop, stabilize, and rise again, but it did.

Another chart: gold. Like copper, gold did not benefit from China’s expansion and globalization until about 2003, which is when increasing wealth boosted gold buying in China just when global macroeconomic forces (low interest rates, weak stock markets, the cyclicality of metal markets) also pushed attention to the yellow metal.

And just like with copper, after its big run gold had to give up some of its paradigm shift gains and find a new bottom before gaining again.

Metals are of course only a small part of the China growth/globalization story, but they illustrate what can happen when investors see a paradigm shift coming and figure ways to position for it.

Where Are We Today?

The green transition is following in the footsteps of major paradigm shifts past. A surge in investor interest at the start pushed values and expectations up too much too quickly. The reset from that coincided with compounding macroeconomic forces that are prolonging the bottom. The next phase of the shift, grounded in real needs and real answers and likely to generate bigger returns, is still ahead.

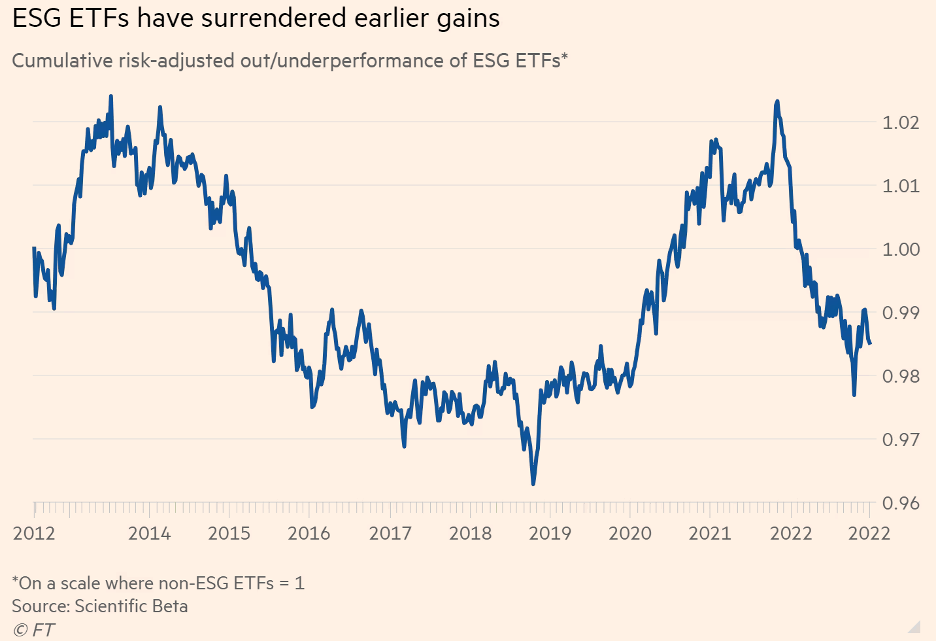

The initial surge in green investor interest is probably best captured by the performance of ESG (environmental-social-governance) funds.

Exchange-traded funds (ETFs) focused on ESG outperformed the markets in their early days (they got going around 2010). Then the shine came off ESG for a range of reasons – lack of clear definition that allowed all kinds of companies (even oil companies making far-future-dated green promises) to get lumped into ESG baskets diminished their appeal, the money printing and behaviour changes following the Great Financial Crisis and COVID created immense opportunity in the broad markets, which reduced the need for targeted investing, and concerns about global growth following COVID have made investors disinterested in assets classes ground in growth, which includes green growth.

Growing pains are part of growing. We’re seeing that very clearly today with carbon credits – the market swooned over this concept in its infancy before abandoning it when evidence surfaced that not all credits were even close to reliable or robust. Carbon credits will shine again because monetizing carbon sinks and carbon output reductions is a necessary part of the green transition, but they are experiencing growing pains right now.

Macroeconomic forces have not helped. Investors have been focused on inflation and rate hikes and AI/big tech and recession worries. Investors have not been positioning for growth. That has left many arenas wanting for attention, including green investing. Green is the new approach to growth, the new frame for how we build and move and develop…so it only steps forward as an investment opportunity when economies are growing.

That will happen again. It might get underway gradually over the next while if we indeed manage a soft landing or it might not happen until after a recession, but it will happen. When investors do focus on growth, it will be like the second wave of the internet boom. Remember how the Nasdaq’s gains from 2007 to today have made the dot com bubble seem nothing more than a blip?! That’s how the next phase of the green transition will feel.

This content is available thanks to subscriber support.

To subscribe to the full newsletter, subscribe to Evergreen Investing here.