From Evergreen Investing: December 2023

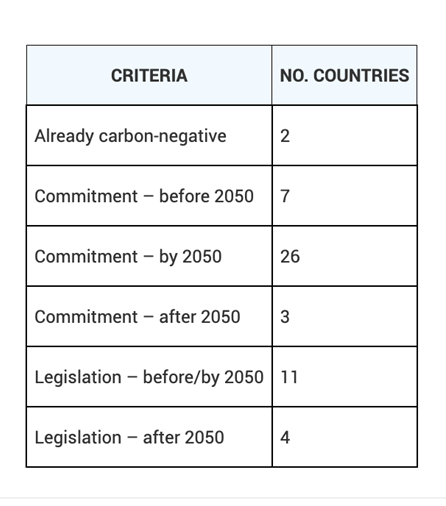

We started Evergreen Investing for one clear reason: climate change is one of the most disruptive economic forces of our lifetimes, a statement underpinned by the fact that 70% of countries representing almost 83% of global emissions and 80% of global population have committed to net zero by 2050.

Dramatic changes in how things are made, moved, and used around the world will generate standout investment opportunities. Paradigm shifts always do (as we discussed in the October issue).

But the green paradigm shift is currently stalled. High interest rates have suffocated capital-intensive green initiatives. Political backlash keeps impeding green directives in many places. And green investment hype five years ago pushed many green stocks sky high; they have since fallen a long way and it takes time for investors to re-engage when a sector sells off significantly.

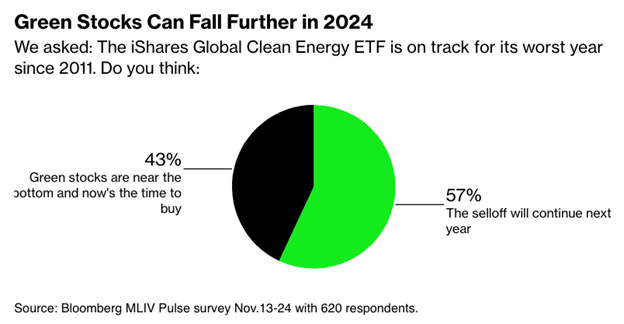

The selloff probably isn’t done. In a recent MLIV Pulse survey, Bloomberg asked investors whether they thought green stocks would fall further.

What I want to discuss today is why we are so confident the green shift is paused, not stopped.

It comes down to two things: political commitments and social shifts.

Political Commitments

A strong majority of the world’s countries are on the net zero path. Thirty-three countries have committed to net zero by or before 2050. Of those, 11 have put that commitment into law: Sweden, the UK, France, Denmark, Norway, Fiji, New Zealand, Hungary, Spain, Germany, and Ireland.

Clearly some very large population centers are not on that list, including China, India, Brazil, and Russia. But the fact remains that countries that are on the list, via legislation or commitment, cover a lot of the world’s population…and money.

So committed change in those places matters. And those commitments are much more than lip service – green is now assumed and guides most things. Even when other needs have pushed green out of the spotlight, as has happened today, politicians mould most major decisions in a green cast.

Take the Inflation Reduction Act. This was a massive bill designed to get the US economy going again after COVID while fighting inflation and reducing the federal budget deficit. It wasn’t meant to be a green bill…but in a crystal-clear example of how green now guides most decisions, green energy investment was seen as one of the key ways to achieve those goals. And so this immense economic recovery bill ended up as the largest investment into addressing climate change in US history.

The point is that major choices in a huge number of countries are now made through green lenses. That won’t revert. And so this pause in the green transition is just that – a pause in a paradigm shift that will re-accelerate when other concerns become less pressing.

Social Shifts

This is about how people think and spend money. And in those areas the biggest shifts towards green have already happened.

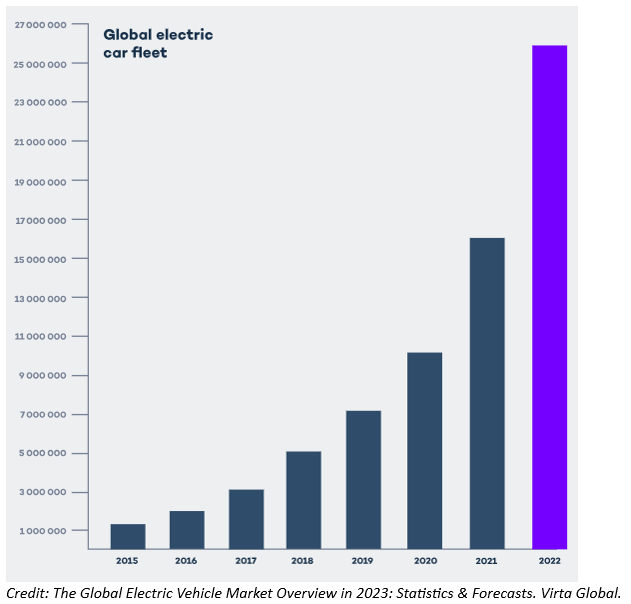

Think back 10 years. Hybrid cars were just becoming common; fully electric cars were still brand new, almost a novelty. Last year 14% of new cars sold around the world were electric (up from 9% in 2021 and less than 5% in 2020). Adoption is expected to hit 18% this year.

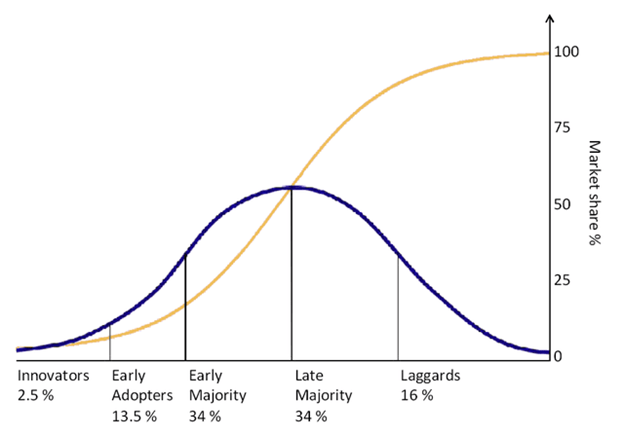

These shifts matter. Once a new technology reaches about 10% adoption, the pace of uptake accelerates and the new technology becomes a given, barring some kind of technological or safety upheaval. We have reached the rapidly rising part of the curve with EVs.

And so when the International Energy Association says the world needs to increase EV adoptions ten fold, have solar panels generating as much power as the entire US generation system currently kicks out, and see electric heat pumps outselling fossil fuel boilers globally in the next ten years – those are not far-fetched statements. In fact, I bet you read that and thought: yup, that’s where we’re heading.

The reality is, we’ve reached escape velocity in scaling renewables and electric vehicles, which are two key areas in the green transition. It took major government policy and support to get here, but that happened and so here we are.

To be sure, governments today are not focused on green. They’re focused on inflation and cost of living and creeping unemployment and huge debt levels and geopolitical tensions and wars and just trying to keep their economies moving forward through this moment until we get back to some stability and growth. Investors similarly have their attention elsewhere.

But when other concerns ease, the need to keep pushing towards net zero and the investment opportunity in that need will step to the fore.

Kinds of Green Opportunity

There are three categories of companies that will benefit when attention turns back to green.

- Sustainability solutions providers – offer products and services that uniquely help customers meet new needs in a net zero world, ideally with products or services that are hard for competitors to replicate at scale.

- Examples: new leading EV battery or semiconductor technologies, automation and information systems that help companies achieve sustainability goals while reducing emissions, top EV brain providers, green cargo management systems

- Sustainability tailwind beneficiaries – companies exposed to areas that will grow within the net zero transition and/or climate change

- Agrifood technologies that boost efficiency and yield while lessening fertilizer and chemical use, packaging with best-in-class recyclability and circularity, miners producing metals of need like silver and copper

- Sustainability leaders – companies offering the most sustainable or lowest-carbon products/services within their sectors, which should make these companies more efficient operators in a net zero world and provide market appeal to increasingly carbon-conscious consumers and investors.

- Waste management services that capture methane from landfills and upgrade it for use, vertical farms serving local populations.

We are researching picks in all of these categories. Given good odds that green stocks aren’t done sliding yet, there’s no rush to enter…but the best time to buy is, of course, when there’s blood on the streets. So we will add a few new positions over the first half of 2024, with an eye always on sentiment.

If a recession starts to develop, we’ll hold off until after.

If the economy sticks a soft landing, growth starts to accelerate, and investors start positioning, we will dive into all three kinds of green opportunities quickly.

It’s great to be ahead of the crowd…but being too early is a lot like being wrong!

This content is available thanks to subscriber support.

To subscribe to the full newsletter, subscribe to Evergreen Investing here.